US non-manufacturing activity surges in September, Dollar rallies

- Go back to blog home

- Latest

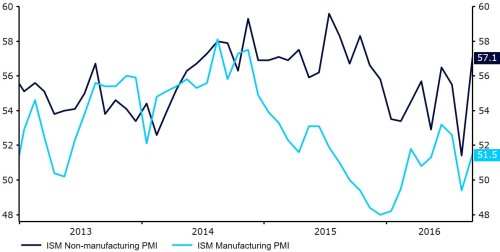

Activity in the non-manufacturing sector of the US economy rose sharply last month, providing further incentive for the Federal Reserve to hike interest rates again in the US before the end of the year.

Figure 1: US Non-Manufacturing PMI (2013 – 2016)

We think this shows that the US economy is performing remarkably well ahead of the Federal Reserve’s next policy meeting in the first week of November and see the Fed as firmly on course to hike rates before the year is out.

Earlier in the day the Pound plunged to its weakest position against the Euro in five years, while touching a fresh three decade trough versus the US Dollar. Investors remain fixated on the growing economic and political uncertainty created following the Brexit vote.

Sterling did, however, receive some respite from its recent sell-off following a slightly better-than-expected services PMI, which suggests that Britain’s economic outlook post-referendum may not be as doom and gloom as many analysts had anticipated.

The European Central Bank will be releasing the minutes from its September monetary policy meeting just after midday today. Investors will be looking for clues as to the possibility of an expansion in the central bank’s quantitative easing programme, with expectation growing that the Governing Council will extend its purchases beyond the existing March 2017 timeframe.

Currency markets will also have one eye on tomorrow’s labour report in the US including the all-important nonfarm payrolls figure. Another solid number around the 171k consensus would provide further reason for traders to buy into the current Dollar rally.

Major currencies in detail:

GBP

The Pound remained pinned around its multi-year lows against both the Dollar and the Euro on Wednesday, although ended the session 0.2% higher against both.

Yesterday’s services PMI added to the growing list of strong economic data in the UK so far this week. The index fell marginally, although remained at a strong 52.6, much higher than July’s dire sub-50 reading that triggered the first Bank of England rate cut since the financial crisis.

Central bank policymaker Ben Broadbent spoke yesterday, reiterating the MPC’s reluctance so cut rates below zero. Broadbent also hinted that another sharp fall in Sterling could have consequences for monetary policy in the UK.

With no economic news out of the UK today, manufacturing and industrial production numbers on Friday morning are the next event in the domestic calendar.

EUR

The single currency slipped 0.2% against the Dollar yesterday, despite some relatively impressive economic news out of the Eurozone.

Service sector growth in the Euro-area was revised upwards for last month, although weak business activity in Germany continues to drag on expansion in the single currency bloc. September’s PMI from Markit was revised to 52.2 from 52.1, with the index in Germany revised upwards by 0.3 points to 50.9. Activity in Germany has been on a particularly alarming downward trend in the past few months, suggesting that the Eurozone economy remains a long way off registering even a modest 2% annual expansion this year.

Retail sales were also little changed, falling 0.1% in the month of August and rising by a slightly underwhelming 0.6% on a year previous.

The ECB’s meeting minutes this afternoon will be the main event in the Euro-area today. Friday’s nonfarm payrolls release in the US remains the main event risk for the single currency this week.

USD

Greenback rose 0.15% against its major peers yesterday, buoyed by encouraging economic data and hawkish comments from Fed Presidents Mester and Lacker earlier in the week.

Investors mostly overlooked yesterday’s slightly underwhelming private sector employment numbers from ADP, which came in marginally less than expected. The private sector in the US added just 154,000 jobs in September, its smallest increase since April and below the previous month’s 175k print.

Economic data today will be relatively light, with attention firmly on Friday’s nonfarm payrolls report. Jobless claims this afternoon are unlikely to prove a big mover.

Receive these market updates via email