US Dollar declines to near two month low ahead of FOMC minutes

- Go back to blog home

- Latest

The US Dollar declined against its major peers for the second straight day on Tuesday, with investors continuing to push back expectations for the next interest rate hike by the Federal Reserve.

The markets brushed aside contrastingly hawkish rhetoric from top Federal Reserve official William Dudley, who suggested an interest rate hike in the US could be coming as soon as the September meeting. Dudley, influential New York Fed President and typically staunch advocate of tightening monetary policy, claimed that the US was ‘edging closer towards the time to raise rates’, with the US economy to be in generally better shape in the second half of the year.

Attention now turns to this evening’s Federal Reserve minutes from its most recent monetary policy meeting. With the Fed last month leaving the door open to a September rate hike in its characteristically vague statement, these minutes will likely shed more light on the chances of a second post-financial crisis hike before the end of the year. Financial markets are currently pricing in around a 40% probability of a hike before the year is out.

Earlier on Tuesday, the Pound recovered from its recent lows following an impressive set of inflation figures, which showed that consumer prices grew by 0.6% in July from 0.5% in June. The effect of a weaker Sterling post-referendum tentatively appears to have provided a slight boost to inflation in the UK.

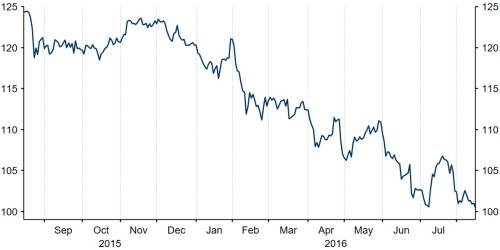

The Japanese Yen surged below 100 to the US Dollar for the first time since the Brexit vote on Tuesday and only the second time in three years. The Yen has been the best performing major currency this year having rallied sharply by over 15% (Figure 1).

Figure 1: USD/JPY (August ‘15 – August ‘16)

Major currencies in detail:

GBP

Sterling rose a sharp 1% against the US Dollar and 0.8% versus the Euro following the impressive set of inflation data, rebounding from its 3 year low against the single currency.

Economic data out of the UK was strong across the board yesterday. Inflation rose to its highest level in 20 months, driven largely by an increase in fuel and alcohol prices. We expect this trend to continue throughout the rest of the year once the full effect of a weaker Sterling begins to filter through to higher prices.

In a more unwelcome development, a weaker Pound caused a significant 6.5% increase in import prices for Britain’s manufacturing sector in July, only the second rise in the sector since September 2013.

This morning’s unemployment and earnings data will be the main announcements in the UK today. Unemployment is expected to remain unchanged at 4.9%, with earnings forecast to have edged higher in June.

EUR

A weak US Dollar and impressive domestic economic data in the Eurozone sent the Euro 0.4% higher yesterday to its strongest position since the Brexit vote.

Economic sentiment in the Eurozone rebounded from its post-referendum slump this month. The latest surveys from ZEW all showed a significant improvement, with the economic sentiment index for the Euro-area increasing to 4.6 from -14.7.

German investor confidence also recovered in August, with the index for Europe’s largest economy increasing to 57.6 from 49.8.

Today will see no major economic data released in the Eurozone. Thursday’s inflation figures and ECB minutes are the main events in the Euro-area this week.

USD

The US Dollar declined 0.4% against its major counterparts yesterday, with Monday night’s comments from John Williams weighing heavily on the currency.

Inflation data for July was also a disappointment yesterday. Headline consumer prices grew just 0.8% in the year after a flat reading for the month, down on the 1% registered in June. The core measure, watched closely by the Fed when deciding on monetary policy, also fell to 2.2% from 2.3%.

There was some slightly better news on the housing front with housing starts increasing sharply last month from 1.186 million to 1.211 million. Industrial production also rose more than expected by 0.7%, although did little to prevent yesterday’s slide in the Dollar.

The Federal Reserve will release its minutes at 19:00 UK time this evening.

Receive these market updates via email