🎙️ FX Talk | Get updated on what's happening on the financial markets in 20 min. listen here.

-

AU

-

Australia - English

- België - Nederlands

- Belgique - Français

- Canada - English

- Česká Republika - Čeština

- Deutschland - Deutsch

- España - Español

- France - Français

- Ελλάδα - Ελληνικά

- Hong Kong - English

- Italia - Italiano

- Luxembourg - English

- Nederland - Nederlands

- Polska - Polski

- Portugal - Português

- România - Română

- Schweiz - Deutsch

- Suisse - Français

- United Arab Emirates - English

- United Kingdom - English

- Hong Kong-Traditional Chinese

-

Australia - English

Ebury London

100 Victoria Street

London

SW1E 5JL

+44 (0) 20 3872 6670

[email protected]

Ebury.com

“Safe haven” currencies strengthen on geopolitical tensions

- Go back to blog home

- Latest

14 August 2017

Chief Risk Officer at Ebury. Committed to mitigating FX risk through tailored strategies, detailed market insight, and FXFC forecasting for Bloomberg.

Tensions in the Korean peninsula disturbed the seasonal quiet in foreign exchange markets last week.

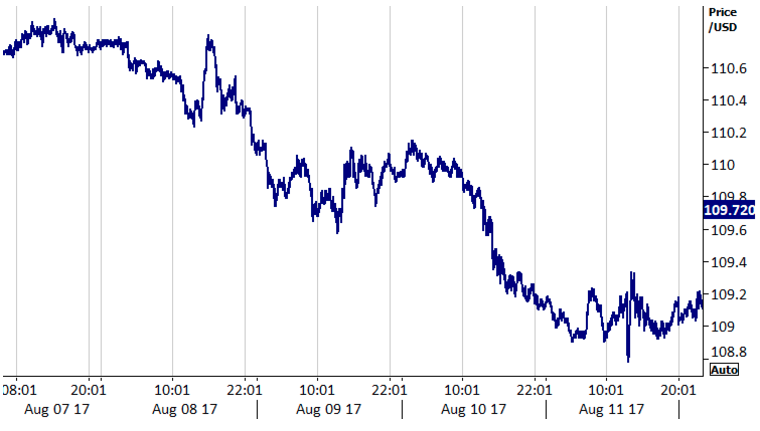

Figure 1: USD/JPY (07/08/2017 – 11/08/2017)

Around the world, equity markets fell and sovereign bond yield declined as volatility indicators everywhere rebounded strongly from recent extraordinarily low levels. The Dollar failed to benefit significantly from the sudden bout of risk aversion, as US interest rates fell and the July inflation number on Friday came in slightly lower than expected.

The biggest move of the week, however, came from the New Zealand Dollar. The kiwi fell sharply against every other major currency, as the Reserve Bank of New Zealand escalated its verbal efforts to keep a lid on its currency.

Aside from unpredictable geopolitical developments, this week will provide little new information to move markets. UK inflation, and the publication of the minutes of the last meeting of both the Federal Reserve and the ECB are just about the only interesting events among major currencies.

Cookies and Privacy

This site uses cookies to ensure you get the best experience. For more information see our Privacy NoticeAccept Settings Reject

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _ga_DGRPXRE06R | 2 years | This cookie is installed by Google Analytics. |

| _gat_gtag_UA_51187572_49 | 1 minute | This cookie is set by Google and is used to distinguish users. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| CONSENT | 16 years 4 months | These cookies are set via embedded youtube-videos. They register anonymous statistical data on for example how many times the video is displayed and what settings are used for playback.No sensitive data is collected unless you log in to your google account, in that case your choices are linked with your account, for example if you click “like” on a video. |

| pardot | past | The cookie is set when the visitor is logged in as a Pardot user. |

| Cookie | Duration | Description |

|---|---|---|

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| yt-remote-connected-devices | never | These cookies are set via embedded youtube-videos. |

| yt-remote-device-id | never | These cookies are set via embedded youtube-videos. |

| Cookie | Duration | Description |

|---|---|---|

| _lfa | 2 years | This cookie is set by the provider Leadfeeder. This cookie is used for identifying the IP address of devices visiting the website. The cookie collects information such as IP addresses, time spent on website and page requests for the visits.This collected information is used for retargeting of multiple users routing from the same IP address. |