🎙️ FX Talk | Get updated on what's happening on the financial markets in 20 min. listen here.

-

AU

-

Australia - English

- België - Nederlands

- Belgique - Français

- Canada - English

- Česká Republika - Čeština

- Deutschland - Deutsch

- España - Español

- France - Français

- Ελλάδα - Ελληνικά

- Hong Kong - English

- Italia - Italiano

- Luxembourg - English

- Nederland - Nederlands

- Polska - Polski

- Portugal - Português

- România - Română

- Schweiz - Deutsch

- Suisse - Français

- United Arab Emirates - English

- United Kingdom - English

- Hong Kong-Traditional Chinese

-

Australia - English

Ebury London

100 Victoria Street

London

SW1E 5JL

+44 (0) 20 3872 6670

[email protected]

Ebury.com

Surprise hung parliament result sends Sterling sharply lower

- Go back to blog home

- Latest

9 June 2017

Senior Market Analyst at Ebury. Providing expert currency analysis so small and mid-sized businesses can effectively navigate international markets.

The worst case scenario is that the parties fail to form a Government at all, or at best manage a short lived one and a new election has to be called. All the while, the Article 50 two-year clock is ticking away with the UK unable to carry out any substantial negotiations.

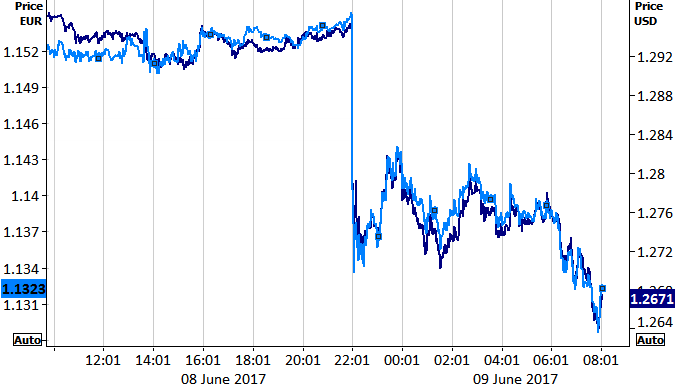

Either way, markets are likely to attach a significant risk premium to Sterling. We think that the path of least resistance for the time being is down, further than the 2% that is has dropped so far (Figure 1). We will soon revise our forecasts accordingly. At any rate, we are probably facing a period of market volatility comparable to that of the immediate aftermath of the Brexit referendum.

Figure 1: GBP/USD & GBP/EUR (09/06/2017)

Dovish Draghi in no rush to begin tightening policy

Prior to the election results in the UK, the ECB kept its monetary policy unchanged on Thursday as expected while dropping the reference in its statement to the possibility of further cuts from its forward guidance.

Comments from ECB President Mario Draghi were relatively mixed. The ECB acknowledged momentum in the Euro-area economy had picked up pace since the last meeting and that growth would be stronger-than-expected. Draghi did, however, reiterate the message that while serious downside risks to the economy had receded, continued QE would be necessary for inflation to reach its target. The ECB actually issued a rather sharp downgrade to its inflation projections and now predicts prices to grow by 1.5% this year (down from 1.7%) and a meagre 1.3% in 2018 (down from 1.6%).

The ECB made it clear it is no hurry to beginning tightening monetary policy and we expect easy monetary policy to remain with us for considerably longer that the markets seems to be pricing in. Markets seem to agree with this view for now and we saw a very modest sell-off in the Euro off the back of the news.

Cookies and Privacy

This site uses cookies to ensure you get the best experience. For more information see our Privacy NoticeAccept Settings Reject

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _ga_DGRPXRE06R | 2 years | This cookie is installed by Google Analytics. |

| _gat_gtag_UA_51187572_49 | 1 minute | This cookie is set by Google and is used to distinguish users. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| CONSENT | 16 years 4 months | These cookies are set via embedded youtube-videos. They register anonymous statistical data on for example how many times the video is displayed and what settings are used for playback.No sensitive data is collected unless you log in to your google account, in that case your choices are linked with your account, for example if you click “like” on a video. |

| pardot | past | The cookie is set when the visitor is logged in as a Pardot user. |

| Cookie | Duration | Description |

|---|---|---|

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| yt-remote-connected-devices | never | These cookies are set via embedded youtube-videos. |

| yt-remote-device-id | never | These cookies are set via embedded youtube-videos. |

| Cookie | Duration | Description |

|---|---|---|

| _lfa | 2 years | This cookie is set by the provider Leadfeeder. This cookie is used for identifying the IP address of devices visiting the website. The cookie collects information such as IP addresses, time spent on website and page requests for the visits.This collected information is used for retargeting of multiple users routing from the same IP address. |