Federal Reserve expected to signal December interest rate hike

- Go back to blog home

- Latest

Improving economic figures

While the Fed opted keep its main interest rate unchanged at between 0.25%-0.5%, the decision not to hike in September was a ‘close call’, with three members of the committee, Ester George, Loretta Mester and Eric Rosengren, all voting in favour of an immediate hike. The committee deemed that economic activity had picked up from the modest pace seen in the first half of the year, although most policymakers decided to wait for additional data on the labour market and inflation.

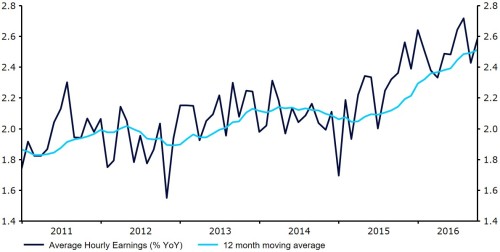

We think that recent economic news out of the US is consistent with a general improvement since mid-year, particularly in the labour market, and puts the Fed firmly on course to hike rates before the end of the year. The US economy created 156,000 jobs at the latest labour report for September, and the twelve month average nonfarm payrolls figure is above the 200,000 level. Average earnings growth remains solid and comfortably above 2% (Figure 1).

Figure 1: US Average Hourly Earnings (2011 – 2016)

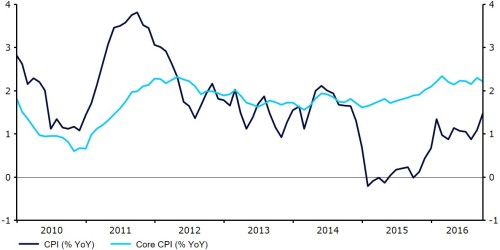

Inflation in the US has also shown encouraging signs of an upward trend, with the effect of the slump in energy prices beginning to filter out of the index. Headline inflation increased to 1.5% in September. More critically, core inflation, which strips out the volatile food and energy components, has been above the Fed’s 2% target throughout the entirety of the year so far (Figure 2).

Figure 2: US Inflation Rate (2010 – 2016), Rhetoric from Federal Reserve members since the last meeting in September has been fairly forthright in the view that higher interest rates are coming in the US. FOMC members Dudley, Rosengren and Evans have all voiced their support behind a 2016 hike, while San Francisco Fed President John Williams stated that he wanted the Fed to raise rates as early as the September meeting.

When will the next interest rate hike happen?

While we think that it is entirely possible that the Fed could decide to hike rates at its November meeting on Wednesday evening, we think that the central bank is much more likely to hold off until December.

Firstly, we think the FOMC is likely to deem it appropriate to wait until after the Presidential Election on the 8th November before hiking rates for only the second time in a decade.

The FOMC will also be releasing an updated set of economic projections in December, including a new ‘dot plot’, where policymakers outline their expected path of future hikes over the coming years. Financial markets seem to be in agreement with this view and are pricing in less than a 20% chance of a hike in November, compared to over a 70% probability in December.

What to expect from this Wednesday’s FOMC meeting

As for the Fed’s statement this Wednesday, we expect the central bank to take a relatively hawkish stance as policymakers prepare the market for the prospect of higher rates in December.

The Fed is likely to highlight the ongoing improvement in the labour market, while signalling a growing confidence that inflation will return to target. We also anticipate an increasing number of dissenters voting in favour of higher rates, bringing the overall vote close to a tipping point where the majority of members vote for an immediate rate increase.

All of which should, in our view, provide good support for the US Dollar against most of its peers.

What does this mean for the US Dollar?

The growing divergence in monetary policy stances between the Federal Reserve and almost every other major G10 central bank has re-emerged as the main driver in the currency markets.

The US Dollar has already strengthened to a nine month high against its trade-weighted basket of currencies (Figure 3) and we forecast it to continue to do so as the Federal Reserve recommences the process of gradually tightening its monetary policy following its first hike in nine years in December 2015.

Figure 3: Trade-Weighted US Dollar Index (October ’15 – October ’16)

, Concerned how these developments may impact your business?

Need to cover your currency exposure?

Contact our expert team