Dollar and Euro rally hand in hand on ECB optimism and rising rates on both sides of the Atlantic

- Go back to blog home

- Latest

The near certainty of a Federal Reserve interest rate hike this week and yet another strong US payroll report failed to make a dent in the EUR/USD rate, which closed the week nearly unchanged.

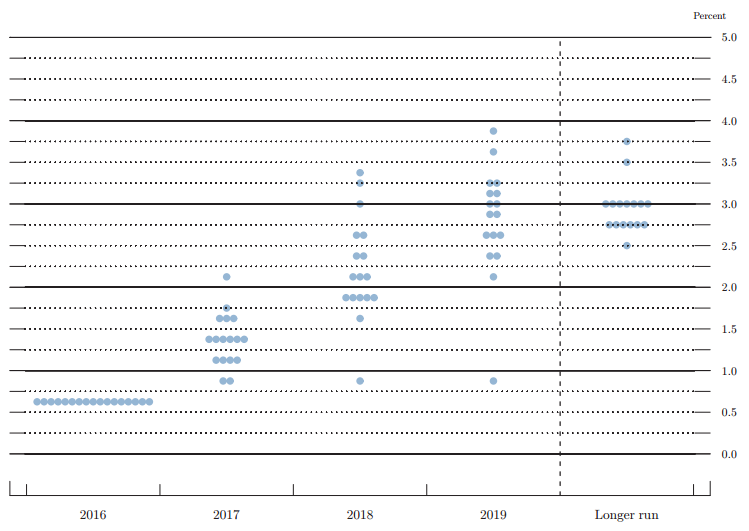

This week is all about the Federal Reserve meeting on Wednesday. While the US payroll report more or less clinched a rate hike, the focus will be on whether the FOMC again upgrades its forecasts for 2017 hikes in its famous ‘dot plot’ (Figure 1).

Figure 1: FOMC December ‘16 ‘Dot Plot’

Another key event takes place on Wednesday as well across the Atlantic, as the Netherlands goes to the polls in its Parliamentary Election. Markets are expecting little fall out and an electoral result that keeps the PVV and its EU-hostile stance out of Government, in line with the most recent polls. Nevertheless, the combination of the Fed meeting and the Dutch election could make for very volatile trading Wednesday night into Thursday morning.

Major currencies in detail

GBP

A Budget thoroughly lacking in big surprises left Sterling to trade listlessly last week. In the end, it lost ground against the US Dollar and the Euro, as positive news in the US and the Eurozone contrasted with increased political risks from Brexit.

This week will be key in setting the tone for the Pound over the medium term. Article 50 appears set to be triggered no later than Wednesday. The Bank of England will also be meeting on Thursday. No change in policy is expected but, as always, communications about the MPC’s future expectations will be critical. Finally, the UK labor market report will also be released on Wednesday. Wage growth may well exceed the market’s modest expectations, providing some badly needed support for Sterling.

EUR

The ECB kept its policy unchanged last Thursday, as universally expected. However, it did strike a modestly more optimistic tone. President Draghi acknowledged that the balance of risks to the Eurozone economy had improved, and declared victory over deflation.

The common currency was also buoyed on Friday by reports that the Council had discussed the possibility of raising rates before the end of QE. Draghi did, however, caution that the ECB’s upgraded forecasts for inflation were contingent on “full implementation” of stated ECB policy, and would tend to discount the possibility of rates being raised in 2017.

This week, event risk in Europe will be focused around the Dutch election on Wednesday and flash readings on the Eurozone March inflation on Thursday.

USD

Stronger than expected numbers out of the US labour market appear to guarantee a 0.25% hike on Wednesday night, when the Federal Reserve holds its March meeting. This event is fully discounted by markets and should therefore have a limited impact.

Of much higher importance will be the tone of FOMC communications and Chair Yellen’s press conference afterwards. In particular, markets will be eager to gauge the reaction to a strong labour market that is nearing full employment, recent increases in core inflation and the stock market rally, which tends to strengthen consumption through the wealth effect. We expect the ‘dot plot’ to reflect an upgrade to four interest rate increases in 2017 and another four in 2018.

Economists and traders have revised their projections for Fed rates sharply upwards recently, but we think they remain behind the curve and see potential for a significant Dollar rally after the Wednesday meeting.