Euro soars to seven week high after Navarro claims currency “grossly undervalued”

- Go back to blog home

- Latest

The Euro jumped to its strongest position against the Dollar in almost two months on Tuesday on the back of a combination of broad Dollar weakness, impressive Eurozone data and comments from Donald Trump’s top trade advisor on the strength of the Euro.

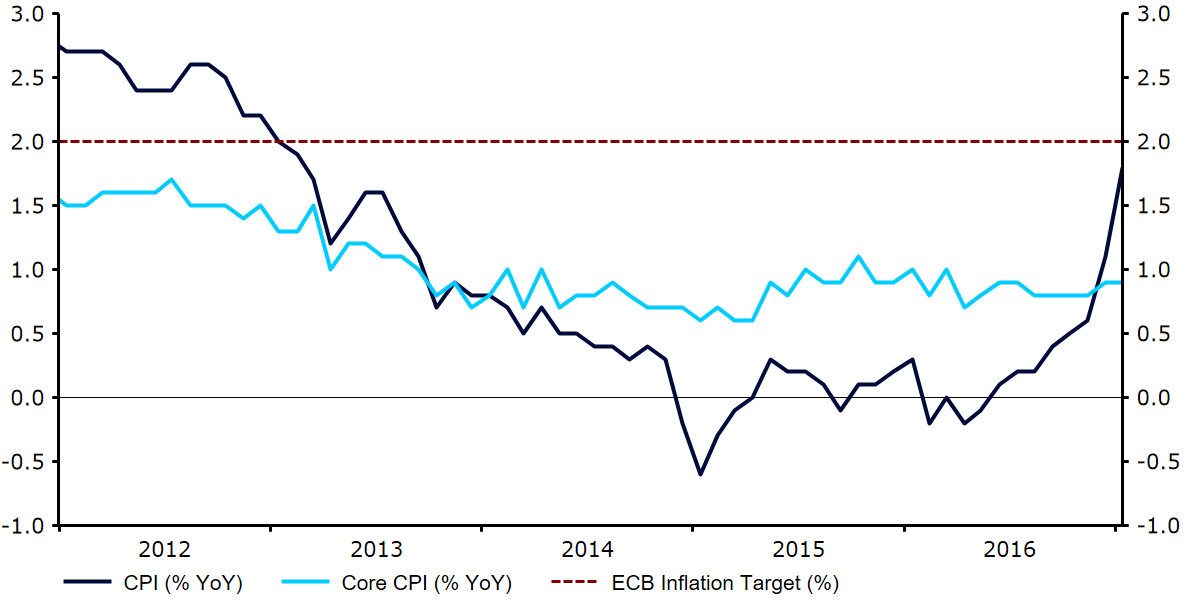

Earlier in the day, economic data released by Eurostat was overwhelmingly positive for the health of the Euro-area economy. Fourth quarter GDP growth exceeded expectations, unemployment fell to a seven year low, while inflation rose sharply to its highest level since 2013 (Figure 1).

Figure 1: Eurozone Inflation Rate (2012 – 2017)

All things considered, yesterday’s news should significantly lessen the pressure on the European Central Bank to ease its monetary policy further in the coming months in its bid to lift inflation to its “close to but below” 2% target.

The Euro’s rally was helped on its way by a broadly weaker US Dollar, which suffered from its worst January performance since 2008. Peter Navarro’s comments on Tuesday added to the growing concern that the Trump administration may be trying to talk down the value of the currency. This follows comments from Trump himself a fortnight ago that suggested the greenback was currently too strong.

Today will be an especially busy day in the currency markets with plenty of economic data releases and announcements. The Federal Reserve will take centre stage this evening when it announces its latest interest rate decision. The Fed is almost certain to hold rates steady and we instead look for hints of additional hikes this year.

Major currencies in detail

GBP

Sterling recovered from early losses against the US Dollar to end the session 0.75% higher.

The Pound fell during early morning trading on Tuesday off the back of a disappointing set of borrowing figures. Personal borrowing in the UK stalled in December, rising by just £1bn in the month, its lowest increase since May 2015. Corporate borrowing also fell short of expectations. The amount of money owed by nonfinancial businesses dipped in the final month of last year for the second month in a row to £449bn.

The manufacturing PMI this morning is expected to slow modestly. Sterling is likely to be driven largely by the FOMC meeting this evening.

EUR

A string of impressive data helped send the Euro 0.9% higher against the US Dollar on Tuesday.

Inflation in the Eurozone jumped in January, with rising energy and food prices boosting price growth to its highest level in nearly four years. Prices grew 1.8% last month on a year previous, considerably higher than the 1.1% recorded in December.

Moreover, GDP growth in the fourth quarter came in better-than-expected. The Eurozone economy grew by 1.7% in the final three months of last year, overtaking the pace of US growth for the first time since the financial crisis in 2008. Unemployment also fell again, with the jobless rate declining to 9.6% in December from a revised 9.7%.

Manufacturing PMI’s for Germany and the wider Euro-area will be the main economic releases in Europe today. European Commission growth forecasts this morning could also receive some attention.

USD

Yesterday’s comments from Navarro sent the Dollar 0.7% lower against its major peers. This extended the greenback’s decline to almost 4% since the beginning of January.

Consumer confidence in the US suffered from a surprisingly sharp decline in January, slipping up from its 15 year high recorded in December. The monthly index dipped to 111.8 from 113.3, with Americans slightly less optimistic about the outlook for job prospects and business conditions.

The Federal Reserve will be announcing its interest rate decision at 7pm London time this evening. Of key importance will be the tone of the statement and hints regarding the potential pace of future hikes in the US in 2017. Financial markets are currently pricing in the next hike in June, although we think that is slightly conservative.