Bank of England cuts interest rate to record low and ramps up QE

- Go back to blog home

- Latest

The Pound fell sharply by over 1% against every major currency on Thursday after the Bank of England launched a sizable raft of stimulus measures aimed at preventing an economic slowdown from taking hold in the UK following June’s Brexit vote.

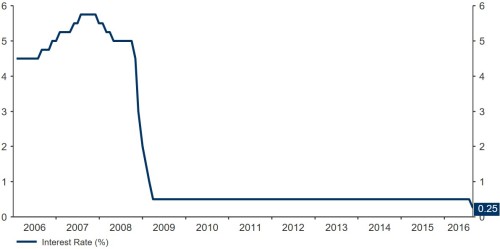

Figure 1: UK Interest Rate (2006 – 2016)

The bank’s quantitative easing programme was also increased, with asset purchases up more than expected by an extra £60 billion to £435 billion. Moreover, the Bank of England will now buy up to £10 billion of corporate debt, while launching a new ‘Term Funding Scheme’ of up to £100 billion in order to ensure commercial banks pass on the full rate cut to their borrowers.

These easing measures are very significant in nature and much more aggressive than the vast majority of economist had anticipated. The shift in tone for the Bank of England in the past few months is clear and we think that further easing measures could be on the way should the next few months’ PMI and growth figures fail to show any meaningful turnaround. Governor Carney even claimed as much by warning the Bank would take ‘whatever action is needed’, which could include an additional rate cut to zero.

Unsurprisingly, Sterling fell sharply on the back of the announcement, ending 1.5% lower against the US Dollar and 1.4% down versus the single currency.

Currency markets have little time for a breather as this afternoon’s US labour report is now firmly in their sights. The crucial nonfarm payrolls number is forecast to print around 180,000, while unemployment is expected to fall back to 4.8%. As always, volatility in the major currencies is to be expected.

Major currencies in detail:

GBP

While comments from Governor Carney yesterday were downbeat, he was surprisingly not overly dovish, ruling out the possibility of both helicopter money and negative interest rates in the UK. Carney warned that the economic outlook had changed ‘markedly’ and had provided a ‘clear case’ for immediate action.

The central bank’s growth forecast were also cut sharply, although not the degree that would amount to a recession. The growth forecast for 2016 remained unchanged at 2%, while the 2017 forecast was cut dramatically to 0.8% from 2.3%.

A much weaker Pound is also likely to ensure the Bank reaches its 2% inflation target quicker than originally anticipated, while Carney explicitly warned that unemployment in the UK could rise by as much as 250,000.

EUR

The Euro was little changed against the US Dollar on Thursday, with very little reaction following the BoE’s announcement.

Economic risks remain to the downside in the Eurozone according to yesterday’s bulletin from the European Central Bank, which warned of an uncertain global outlook following the Brexit vote. The bulletin struck a very similar tone to recent dovish commentary from ECB President Mario Draghi and, in our view, remains consistent with additional easing measures from the ECB this year.

The second tier economic data out of France and Germany this morning is unlikely to shift the Euro today. The single currency will instead rely heavily on this afternoon’s US labour report.

USD

The US Dollar had a mixed experience yesterday, ending 0.2% higher against its major peers, with all attention now turning to this afternoon’s labour report.

With focus firmly on events in the UK yesterday, economic announcements in the US mostly went unnoticed. Jobless claims remained strong and consistent with an improving labour market, although rose slightly by 3,000 to 269,000 for last week. Factory order surprised on the upside, although still fell by 1.5% in the month to June, hampered by weak demand and a strong Dollar.

Today’s labour report at 13:30 UK time will dominate announcements in the US today. We think another strong number would cause the market to bring forward its expectation for the next Fed interest rate hike to December, thus recommencing the US Dollar’s rally against most major currencies.

Receive these market updates via email